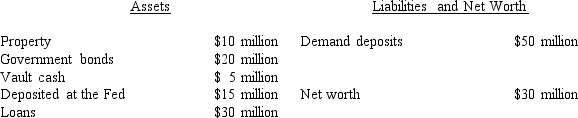

Given the balance sheet below and assuming a required reserve ratio of 20 percent,how much (in dollar terms) must the bank hold in required reserves?

A) It is failing to meet its reserve requirement.

B) It is just meeting its reserve requirement,but has no excess reserves.

C) It is meeting its reserve requirement,and has $5 million in excess reserves.

D) It is meeting its reserve requirement,and has $10 million in excess reserves.

E) It is meeting its reserve requirement,and has $15 million in excess reserves.

Correct Answer:

Verified

Q65: A bank's balance sheet shows

A) information about

Q66: Given the balance sheet below and assuming

Q67: If the required reserve ratio is 0.2,and

Q68: Which of the following is a liability

Q69: One reason for the differences between the

Q71: If a commercial bank has liabilities valued

Q72: Reserves are defined as

A) the total cash

Q73: Demand deposits are liabilities to a bank

Q74: Macro National Bank,a commercial bank,holds $1 million

Q75: If a bank's total assets are $150

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents