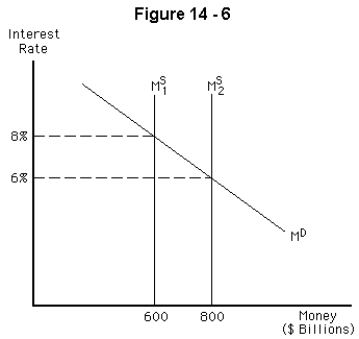

-Refer to Figure 14-6.Suppose the Fed increases the money supply (to ) .As a result,the interest rate falls initially to 6 percent.After spending and GDP change,what will happen to the interest rate?

A) It will remain at 6 percent.

B) It will rise as the money supply curve shifts back toward

C) It will rise as the money demand curve shifts to the right.

D) It will fall as the money supply curve shifts farther to the right.

E) It will fall as the money demand curve shifts to the left.

Correct Answer:

Verified

Q93: Open market purchases of bonds by the

Q94: In the short-run macro model,a decrease in

Q95: A rise in the interest rate tends

Q96: Which of the following will increase both

Q97: In the short-run macro model,an open-market purchase

Q99: If the Fed decreases the money supply,we

Q100: For which of the following goods is

Q101: The federal funds rate is closely tied

Q102: In the long run,the interest rate is

Q103: Which of the following would shift the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents