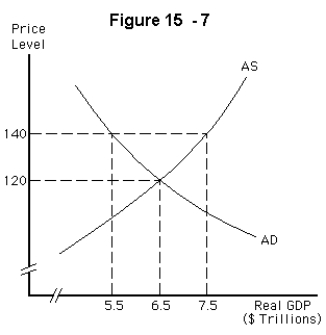

-Refer to Figure 15-7.If the economy is currently at a price level of 120 and real GDP is $6.5 trillion,an increase in taxes will,in the short run,

A) shift the aggregate demand curve rightward,increasing both the price level and real GDP

B) shift the aggregate demand curve leftward,decreasing both the price level and real GDP

C) shift the aggregate supply curve upward,increasing the price level and decreasing real GDP

D) shift the aggregate supply curve downward,decreasing the price level and increasing real GDP

E) have no effect on aggregate demand because of crowding out

Correct Answer:

Verified

Q86: Q87: The economy's self-correcting mechanism Q88: If government spending decreases,which of the following Q89: The decline in output at the onset Q90: If output exceeds its full-employment level,the wage Q92: If the government decreases taxes,which of the Q93: The self-correcting mechanism is the reason that Q94: Equilibrium GDP Q95: In the short run,a contractionary fiscal policy Q96: A negative demand shock![]()

A) prevents the economy

A) is not affected by nominal

A) shifts the AD

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents