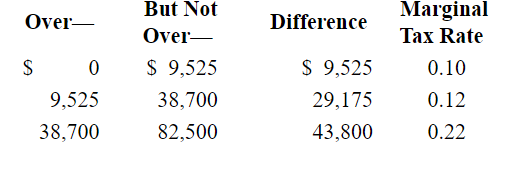

Following is a partial personal taxable income schedule for a single filer:  What would be the cumulative dollar amount of income taxes paid by a single filer who has taxable income of $38,700?

What would be the cumulative dollar amount of income taxes paid by a single filer who has taxable income of $38,700?

A) $922.50

B) $1,143.00

C) $3,501.00

D) $4,453.00

Correct Answer:

Verified

Q75: Following is a partial personal taxable income

Q76: The total dollar amount of federal income

Q77: Based on 2018 tax schedules, the first

Q78: Based on 2018 tax schedules, the highest

Q79: Intellectual property can be protected by all

Q81: Patents that cover most inventions pertaining to

Q82: Which of the following is not a

Q83: Which of the following forms of protecting

Q84: Which of the following is not a

Q85: The Leahy-Smith America Invents Act of 2011

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents