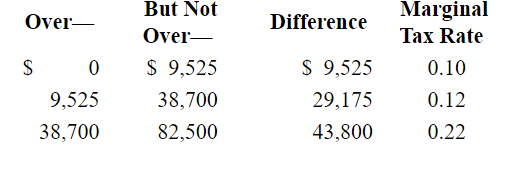

Following is a partial personal taxable income schedule for a single filer:  The average tax rate for a single filer with taxable income of $38,700 would be:

The average tax rate for a single filer with taxable income of $38,700 would be:

A) 10.0%

B) 11.5%

C) 12.0%

D) 17.1%

Correct Answer:

Verified

Q70: Which of the following are intellectual property

Q71: The total dollar amount of federal income

Q72: Following is a partial personal taxable income

Q73: Which of the following forms of protecting

Q74: Which of the following numbers of shareholders

Q76: The total dollar amount of federal income

Q77: Based on 2018 tax schedules, the first

Q78: Based on 2018 tax schedules, the highest

Q79: Intellectual property can be protected by all

Q80: Following is a partial personal taxable income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents