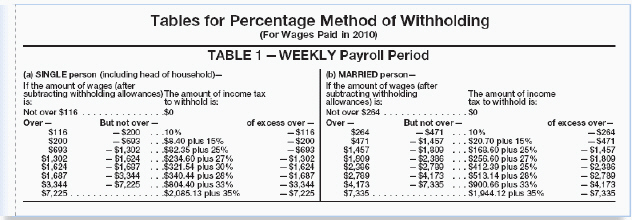

Lewis is single with one allowance. He has gross weekly earnings of $525.00. He can deduct $70.19 from his gross earnings for the allowance. Use the percentage method table to find the amount of weekly federal income tax withheld.

A) $38.22

B) $46.62

C) $74.42

D) $84.95

Correct Answer:

Verified

Q1: Chris Gabarkowitz worked 40 hours straight time

Q3: Attus Nasos is married with five allowances.

Q4: Ramona worked 37 hours last week. She

Q5: Raj lives in a state where there

Q6: Terrence worked as a lifeguard 23 hours

Q7: Roberta Parke recently got hired as a

Q8: Kermit Jacobs is married with 5 allowances.

Q9: Ron Woerner works in a factory. He

Q10: Mrs. Thomson had gross earnings of $1,345.90

Q11: A payroll clerk is calculating the amount

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents