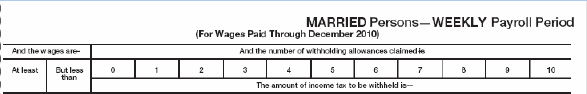

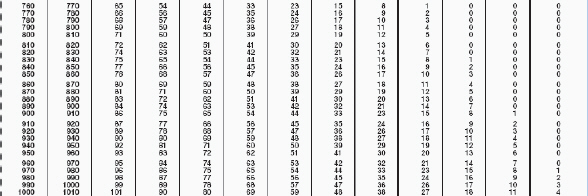

Jackson is married with four allowances. His gross earnings are $922 a week. Use the table to find the amount of weekly federal income tax withheld.

Correct Answer:

Verified

Q27: Latina had gross earnings of $562.90 last

Q28: Mr. Griffin worked 40 hours straight time

Q29: In the last four weeks, Case Janson

Q30: As an electrician, Jason gets paid double

Q31: Bhairav Nagesh is a computer programmer. Bhairav

Q33: The more withholding allowances that Rolanda claims,

Q34: An accountant is calculating the amount to

Q35: Social Security and Medicare taxes are collected

Q36: Tom Chambers had gross earning of $425.80

Q37: Harlan does payroll for a local deli.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents