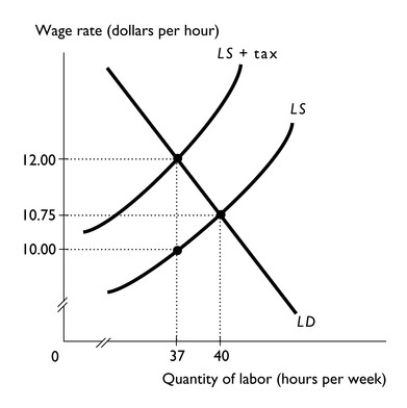

-The figure above shows a labor market in which an income tax has been imposed.

a.How many hours of labor were employed before the tax was imposed?

b.How many hours of labor are employed after the tax?

c.What was the wage rate employers paid and that workers received before the tax?

d.What is the wage rate employers pay and that workers receive after the tax?

e.What accounts for the difference between what employers pay and what workers receive?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q260: What is the marginal tax rate? Average

Q261: What is the difference between vertical equity

Q262: In a labor market before any taxes

Q263: Q264: Q265: What are the two conflicting principles of Q267: "The only fair tax is a progressive Q268: What are the similarities and differences between Q269: If the marginal tax rate is 20 Q270: Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()