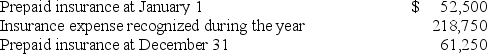

When Castle Corporation pays insurance premiums, the transaction is recorded as a debit to prepaid insurance. Additional information for the year ended December 31 is as follows:  What was the total amount of cash paid by Castle for insurance premiums during the year?

What was the total amount of cash paid by Castle for insurance premiums during the year?

A) $218,750

B) $166,250

C) $210,000

D) $227,500

Correct Answer:

Verified

Q71: Compared to the accrual basis of accounting,

Q72: Temporary accounts would not include:

A) Salaries payable.

B)

Q73: When converting an income statement from a

Q74: When converting an income statement from a

Q76: The purpose of closing entries is to

Q78: Match the following terms with their definitions.

-Accounts

Q78: On June 1, Royal Corp. began operating

Q79: The Hamada Company sales for 2018 totaled

Q80: The accounting processing cycle:

A) Is a three-wheeled

Q95: Match each of the following items with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents