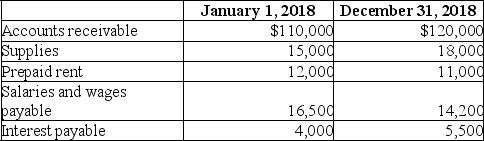

Claymore Corporation maintains its book on a cash basis. During 2018, the company collected $825,000 in fees from its clients and paid $512,000 in expenses. You are able to determine the following information about accounts receivable, supplies, prepaid rent, salaries payable, and interest payable:  In addition, 2018 depreciation expense on office equipment and furniture is $55,000.

In addition, 2018 depreciation expense on office equipment and furniture is $55,000.

Required:

Determine accrual basis net income for 2018.

Correct Answer:

Verified

Q116: Suppose that Laramie Company's adjusted trial balance

Q117: Rite Shoes was involved in the transactions

Q118: Q119: You are reviewing O'Brian Co.'s adjusted trial Q120: Q122: Raintree Corporation maintains its records on a Q123: Describe what is meant by deferred revenue Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()