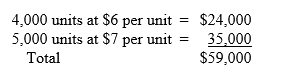

Hazelton Corporation uses a periodic inventory system and the LIFO method to value its inventory. The company began 2018 with $59,000 in inventory of its only product. The beginning inventory consisted of the following layers:

During 2018, 6,000 units were purchased at $8 per unit and during 2019, 7,000 units were purchased at $9 per unit. Sales, in units, were 7,000 and 12,000 during 2018 and 2019, respectively.

Required:

1. Calculate cost of goods sold for 2018 and 2019.

2. Disregarding income tax, determine the LIFO liquidation profit or loss, if any, for 2018 and 2019.

Correct Answer:

Verified

Cost of goods sold:

2018: 1,000 x $7 ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q58: Match the following terms with their definitions.

-LIFO

A)Average

Q135: Patty's Pet Store purchased merchandise on October

Q136: Listed below are 10 terms, followed by

Q137: Listed below are 10 terms, followed by

Q141: The following information is taken from the