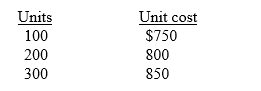

Modern Day Appliances, Inc. is a wholesaler of kitchen appliances. The company uses a periodic inventory system and the LIFO cost method. Modern Day's December 31, 2018, fiscal year-end inventory of its main product, double-door stainless steel refrigerators, consisted of the following (listed in chronological order of acquisition):

The replacement cost of the refrigerators throughout 2019 was $900. Modern Day sold 5,000 of these refrigerators during 2019. The company's selling price throughout 2019 was $1,200.

Required:

1. Compute the gross profit (sales minus cost of goods sold) and the gross profit ratio for 2019 assuming that Modern Day purchased 5,200 units during the year.

2. Repeat requirement 1 assuming that Modern Day purchased only 4,500 units.

3. For requirements 1 and 2, what amount of before-tax LIFO liquidation profit or loss would Modern Day report in its 2019 disclosure notes, if any, assuming any calculated amount is material?

Correct Answer:

Verified

Sales (5,000 units x $1,200) $6,000,0...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q165: Spando Apparel uses the LIFO inventory method

Q166: Selected financial statement data from Western Colorado

Q167: Appleton Inc. adopted dollar-value LIFO on January

Q168: Briefly describe why companies that use perpetual

Q169: The inventories disclosure note in the 2014

Q171: On January 1, 2017, RAY Co. adopted

Q172: The table below contains selected financial information

Q173: Briefly explain when there would be a

Q174: Costs and prices regularly fall every year

Q175: It is the end of the accounting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents