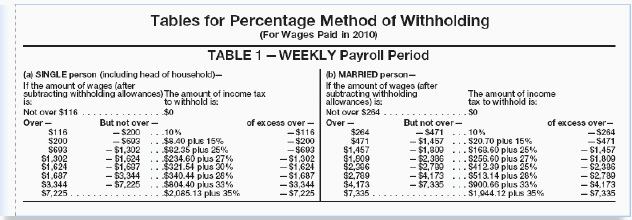

Attus Nasos is married with five allowances. He has gross weekly earnings of $1,175. For each withholding allowance, he can deduct $70.19 from his gross earnings. Use the percentage method table to find the amount of weekly federal income tax withheld.

A) $52.96

B) $73.66

C) $70.19

D) $123.60

Correct Answer:

Verified

Q10: Mrs. Thomson had gross earnings of $1,345.90

Q13: Erwin works as a plumber. He earns

Q15: Xavier has a job stocking groceries. He

Q18: The ROUND function in Excel can be

Q18: Michael Lewis earns $71,500 a year, so

Q19: Nigel has a $43.89 deduction from his

Q21: Jackson is married with four allowances. His

Q23: Karen's compensation is based on piecework. She

Q33: The more withholding allowances that Rolanda claims,

Q36: Tom Chambers had gross earning of $425.80

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents