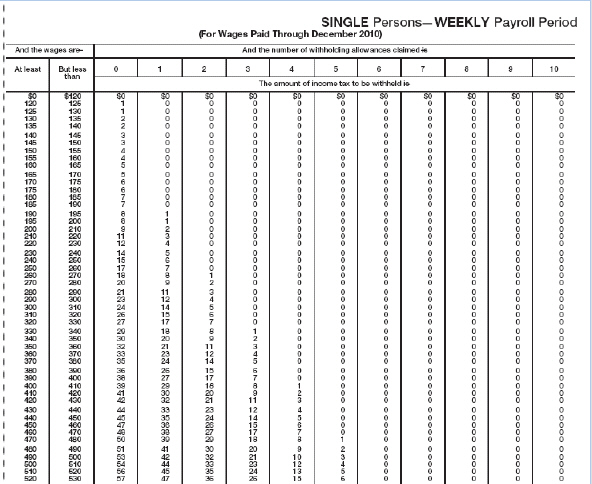

Tanya Benson is single with three allowances and has gross weekly earnings of $480.00. Use the table to find the amount of weekly federal income tax withheld.

Correct Answer:

Verified

Q21: Jackson is married with four allowances. His

Q23: Karen's compensation is based on piecework. She

Q24: The FICA or Federal Insurance Contributions Act

Q26: Mary Ellen works at a produce market

Q28: Mr. Griffin worked 40 hours straight time

Q30: As an electrician, Jason gets paid double

Q31: Bhairav Nagesh is a computer programmer. Bhairav

Q33: The more withholding allowances that Rolanda claims,

Q35: Social Security and Medicare taxes are collected

Q36: Tom Chambers had gross earning of $425.80

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents