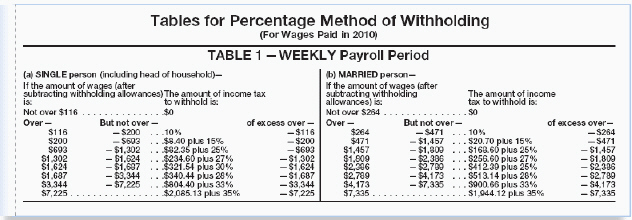

Maya Costello is married with two allowances. She has gross weekly earnings of $378.90. For each withholding allowance she can deduct $70.19 from her gross earnings. Use the percentage method table to find the amount of weekly federal income tax withheld.

Correct Answer:

Verified

$378....

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Katelyn works from home assembling craft kits.

Q34: An accountant is calculating the amount to

Q38: McKenzie earns a weekly salary of $350

Q41: A payroll register has the employees' names

Q42: Ronald Brown is a bookkeeper for Telacom.

Q43: In the last two weeks, McKenzie earned

Q44: A spreadsheet contains employee salary information used

Q45: Loretta is single with two allowances. Her

Q47: LeMonte earns $239.60 each week. He lives

Q48: Manny is completing a payroll register for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents