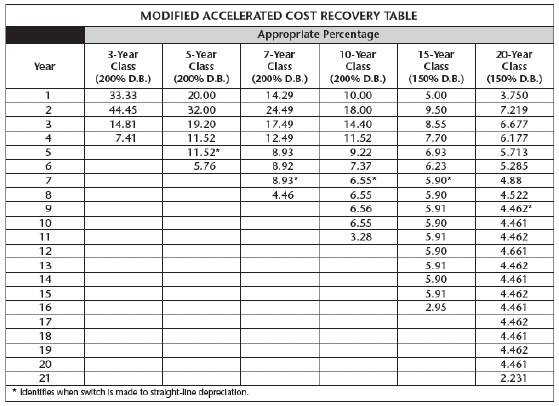

What is the third-year depreciation of a copier that originally cost $3,800? Use the MACRS method.

A) $224.58

B) $437.76

C) $729.60

D) $1,216

Correct Answer:

Verified

Q7: Julie bought a boat at the beginning

Q8: What is the second-year depreciation of a

Q9: When adding all annual depreciation, the total

Q10: What is the sixth-year depreciation of a

Q11: The original cost of a truck was

Q13: The original cost of a wave runner

Q14: The original cost of a car was

Q15: The original cost of a motorcycle was

Q16: The salvage value is deducted when calculating

Q17: Full Depreciation is the total amount of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents