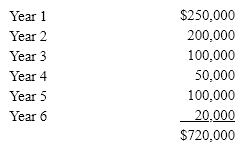

Proposals L and K each cost $600,000, have 6-year lives, and have expected total cash flows of $720,000. Proposal L is expected to provide equal annual net cash flows of $170,000, while the net cash flows for Proposal K are as follows:

Determine the cash payback period for each proposal. Round your answers to two decimal places.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q143: What is capital investment analysis? Why are

Q144: Determine the average rate of return for

Q145: Proposals M and N each cost $550,000,

Q146: Proposals A and B each cost $600,000

Q152: The process by which management allocates available

Q154: Determine the average rate of return for

Q156: Tipper Co.is considering a 10-year project that

Q165: A project has estimated annual net cash

Q167: Identify four capital investment evaluation methods discussed

Q179: Jimmy Co. is considering a 12-year project

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents