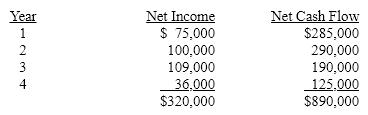

Dickerson Co. is evaluating a project requiring a capital expenditure of $810,000. The project has an estimated life of 4 years and no salvage value. The estimated net income and net cash flow from the project are as follows:

The company's minimum desired rate of return is 12%. The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is 0.893, 0.797, 0.712, and 0.636, respectively.

Determine the average rate of return on investment, including the effect of depreciation on the investment.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q146: All of the following are factors that

Q149: In capital rationing,an initial screening of alternative

Q152: A 6-year project is estimated to cost

Q152: The process by which management allocates available

Q155: BAM Co. is evaluating a project requiring

Q155: An 8-year project is estimated to cost

Q161: Sunrise Inc. is considering a capital investment

Q162: Match each definition that follows with the

Q163: Dickerson Co. is evaluating a project requiring

Q166: A project has estimated annual net cash

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents