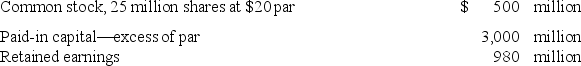

The 12/31/2018 balance sheet of Despot Inc. included the following:  In January 2018, Despot recorded a transaction with this journal entry:

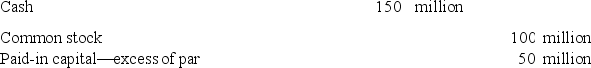

In January 2018, Despot recorded a transaction with this journal entry:

- Despot declared a property dividend to give marketable equity securities to its common stockholders. The securities had cost Despot $7 million and currently have a fair value of $16 million. Which of the following would be included in recording the property dividend declaration?

A) Increase in a liability for $16 million.

B) Decrease in retained earnings for $7 million.

C) Decrease in marketable securities by $16 million.

D) All of these answer choices are correct.

Correct Answer:

Verified

Q54: Authorized common stock refers to the total

Q55: Poodle Corporation was organized on January 3,

Q56: Paid-in capital in excess of par is

Q57: When stock traded on an active exchange

Q58: Which of the following transactions decreases retained

Q60: When stock is issued in exchange for

Q61: In 2016, Winn, Inc., issued $1 par

Q62: When a property dividend is declared, the

Q63: Boxer Company owned 20,000 shares of King

Q64: Preferred shares that are participating may:

A) Vote

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents