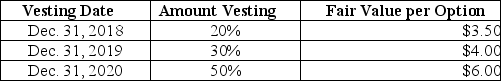

Pastner Brands is a calendar-year firm with operations in several countries. As part of its executive compensation plan, at January 1, 2018, the company had issued 20 million executive stock options permitting executives to buy 20 million shares of stock for $25. The vesting schedule is 20% the first year, 30% the second year, and 50% the third year (graded-vesting). The fair value of the options is estimated as follows:  Required:

Required:

Determine the compensation expense related to the options to be recorded each year for 2018-2020, assuming Pastner prepares its financial statements in accordance with International Financial Reporting Standards (IFRS).

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q216: Blair Systems offers its employees a

Q217: At the end of 2018, what is

Q218: Paul Company had 100,000 shares of common

Q219: What is the treasury stock method of

Q220: What is restricted stock? Describe how compensation

Q222: If executive stock options or restricted stock

Q223: Compare the concepts of basic and diluted

Q224: Why are preferred dividends deducted from net

Q225: What is the advantage of stock appreciation

Q226: What is an antidilutive security?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents