Use the following to answer questions

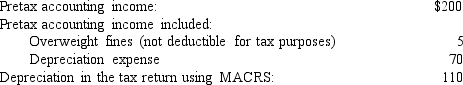

The following information relates to Franklin Freightways for its first year of operations (data in millions of dollars) :

The applicable tax rate is 40%.There are no other temporary or permanent differences.

The applicable tax rate is 40%.There are no other temporary or permanent differences.

-Which of the following must Franklin Freightways disclose related to the income tax expense reported in the income statement ($ in millions) ?

A) Only the current portion of tax expense of $66.

B) Only the total tax expense of $82.

C) Both the current portion of the tax expense of $66 and the deferred portion of the tax expense of $16.

D) None of these answer choices are correct.

Correct Answer:

Verified

Q23: Which of the following statements is true

Q26: Ignoring operating expenses,what deferred tax liability would

Q27: Which of the following creates a deferred

Q28: Use the following to answer questions

For

Q28: Which of the following differences between financial

Q30: Ignoring operating expenses and additional sales in

Q32: Which of the following usually results in

Q33: Use the following to answer questions

The

Q34: Use the following to answer questions

For

Q36: Which of the following differences between financial

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents