Use the following to answer questions

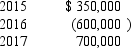

Puritan Corp.reported the following pretax accounting income and taxable income for its first three years of operations:

Puritan's tax rate is 40% for all years.Puritan elected a loss carryback.

Puritan's tax rate is 40% for all years.Puritan elected a loss carryback.

As of December 31,2016.Puritan was certain that it would recover the full tax benefit of the

NOL that remained after the operating loss carryback.

-What would be the net loss in 2016 reported in Puritan's income statement?

A) $360,000.

B) $240,000.

C) $460,000.

D) $500,000.

Correct Answer:

Verified

Q83: In its first four years of operations

Q83: Before considering a net operating loss carryforward

Q84: Use the following to answer questions

Puritan

Q85: According to GAAP for accounting for income

Q85: At December 31,2016,Moonlight Bay Resorts had the

Q89: Theodore Enterprises had the following pretax income

Q90: Use the following to answer questions

Puritan

Q91: For reporting purposes,current deferred tax assets and

Q92: In its first three years of operations

Q97: The tax effect of a net operating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents