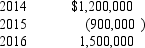

Clinton Corp.had the following pretax income (loss) over its first three years of operations:

For each year there were no deferred income taxes and the tax rate was 40%.For its 2015 tax return,Clinton did not elect a net operating loss carryback.No valuation account was deemed necessary for the deferred tax asset as of December 31,2015.What was Clinton's income tax expense in 2016?

A) 600,000.

B) 480,000.

C) 240,000.

D) 160,000.

Correct Answer:

Verified

Q68: Which of the following causes a permanent

Q70: The valuation allowance account that is used

Q76: In reconciling net income to taxable income,

Q77: Pretax accounting income for the year ended

Q78: In 2015,HD had reported a deferred tax

Q82: A net operating loss (NOL)carryforward cannot result

Q83: In its first four years of operations

Q84: Use the following to answer questions

Puritan

Q85: At December 31,2016,Moonlight Bay Resorts had the

Q85: According to GAAP for accounting for income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents