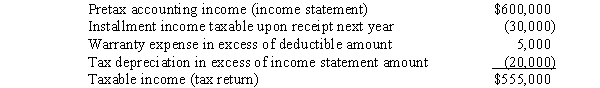

A reconciliation of pretax financial statement income to taxable income is shown below for See Shipping for the year ended December 31,2016,its first year of operations.The income tax rate is 40%.

What amount should See report as a current item related to deferred income taxes in its 2016 balance sheet?

A) Deferred income tax asset of $12,000.

B) Deferred income tax asset of $2,000.

C) Deferred income tax liability of $12,000.

D) Deferred income tax liability of $10,000.

Correct Answer:

Verified

Q101: North Dakota Corporation began operations in January

Q102: Listed below are five independent situations.For each

Q103: What is Hobson's income tax payable for

Q104: A reconciliation of pretax financial statement income

Q105: Madison Company has taken a position in

Q107: Several years ago,Western Electric Corp.purchased equipment for

Q109: What should Hobson report as net income?

A)$70

Q111: How much tax expense on income from

Q112: On its tax return at the end

Q123: In its 2018 annual report to shareholders,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents