Use the following to answer question

In its 2016 annual report to shareholders,Black Inc.disclosed the following information about income taxes.

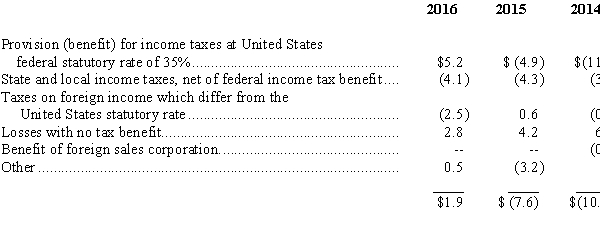

A reconciliation of income taxes computed at the United States federal statutory income tax rate (35%)to the provision (benefit)for income taxes reflected in the Consolidated Statement of Operations for the years ended December 31,2016,2015,2014,is as follows ($ in millions):  The significant components of the net deferred tax assets at December 31,2016 and 2015,were as follows ($ in millions):

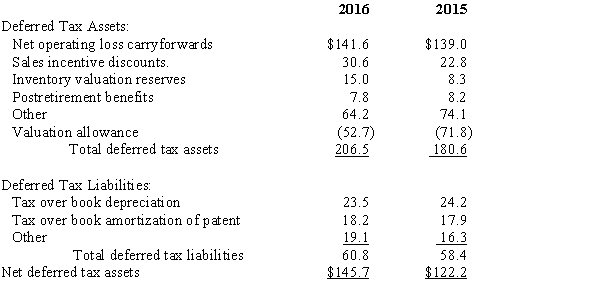

The significant components of the net deferred tax assets at December 31,2016 and 2015,were as follows ($ in millions):

-Estimate the effective tax rate for Black Inc.in 2016.Why is it different from the 35% federal statutory rate?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q111: How much tax expense on income from

Q114: What should Hobson report as income from

Q116: Listed below are 5 terms followed by

Q117: Listed below are 5 terms followed by

Q118: Listed below are five independent situations.For each

Q119: Due to differences between depreciation reported in

Q119: Listed below are 5 terms followed by

Q120: How should Hobson report tax on the

Q123: In its 2018 annual report to shareholders,

Q127: Roberts Corp. reports pretax accounting income of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents