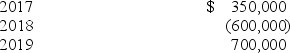

Puritan Corp. reported the following pretax accounting income and taxable income for its first three years of operations:  Puritan's tax rate is 40% for all years. Puritan elected a loss carryback.

Puritan's tax rate is 40% for all years. Puritan elected a loss carryback.

- As of December 31, 2018. Puritan was certain that it would recover the full tax benefit of the NOL that remained after the operating loss carryback.

What did Puritan report on December 31, 2018, as the deferred tax asset for the NOL carryforward?

A) $280,000.

B) $200,000.

C) $100,000.

D) $0.

Correct Answer:

Verified

Q79: Which of the following causes a permanent

Q80: Under current tax law, generally a net

Q81: In its first three years of operations

Q82: The Kelso Company had the following operating

Q83: Before considering a net operating loss carryforward

Q85: According to GAAP for accounting for income

Q86: Recognizing tax benefits in a loss year

Q87: Assuming no other deferred tax items exist

Q88: Theodore Enterprises had the following pretax

Q89: If a company's deferred tax asset is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents