In LMC's 2018 annual report to shareholders, it disclosed the following information about its income taxes:

INCOME TAXES

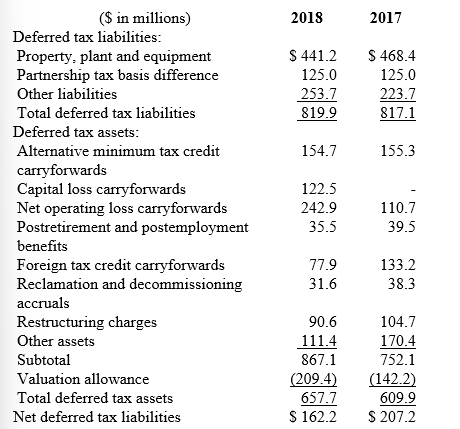

Deferred income taxes reflect the net tax effects of temporary differences between the amounts of assets and liabilities for accounting purposes and the amounts used for income tax purposes.

Significant components of the Company's deferred tax liabilities and assets as of December 31 were as follows:

-Explain why LMC has a $209.4 million valuation allowance for its deferred tax assets.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q137: Listed below are 5 terms followed by

Q138: Listed below are five independent situations. For

Q139: Listed below are five independent situations. For

Q140: Listed below are 5 terms followed by

Q141: In the current year, Bruno Corporation collected

Q143: Typical Corp. reported a deferred tax liability

Q144: In LMC's 2018 annual report to shareholders,

Q145: Four independent situations are described below. Each

Q146: Pocus Inc. reports warranty expense when related

Q147: Patterson Development sometimes sells property on an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents