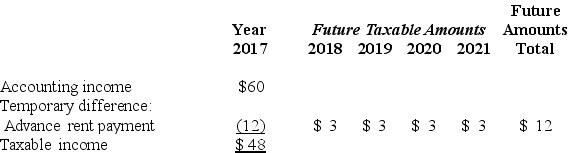

The following information is for James Industries' first year of operations. Amounts are in millions of dollars.  In 2018 the company's pretax accounting income was $67. The enacted tax rate for 2017 and 2018 is 40%, and it is 35% for years after 2018.

In 2018 the company's pretax accounting income was $67. The enacted tax rate for 2017 and 2018 is 40%, and it is 35% for years after 2018.

Required:

Prepare a journal entry to record the income tax expense for the year 2018. Show well-labeled computations for income tax payable and the change in the deferred tax account.

Correct Answer:

Verified

Q145: Four independent situations are described below. Each

Q146: Pocus Inc. reports warranty expense when related

Q147: Patterson Development sometimes sells property on an

Q148: The information below pertains to Mondavi Corporation:

(a.)

Q149: Typical Corp. reported a deferred tax liability

Q151: The information that follows pertains to Julia

Q152: Pocus, Inc., reports warranty expense when related

Q153: At the end of the prior year,

Q154: Tobac Company reported an operating loss of

Q155: Two independent situations are described below. Each

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents