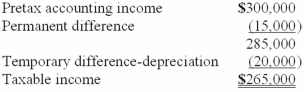

For its first year of operations, Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows:  Tringali's tax rate is 40%. What should Tringali report as its income tax expense for its first year of operations?

Tringali's tax rate is 40%. What should Tringali report as its income tax expense for its first year of operations?

A) $120,000.

B) $114,000.

C) $106,000.

D) $8,000.

Correct Answer:

Verified

Q5: The classification of deferred tax assets is

Q6: A deferred tax asset represents the tax

Q7: Which of the following causes a temporary

Q8: Future taxable amounts result in deferred tax

Q10: Which of the following differences between financial

Q13: Revenues from installment sales of property reported

Q14: A result of inter-period tax allocation is

Q17: Expenditures currently deducted in the tax return

Q19: The basic issue in deciding whether to

Q26: Which of the following circumstances creates a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents