Use the following to answer questions

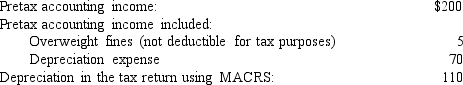

The following information relates to Franklin Freightways for its first year of operations (data in millions of dollars) :

The applicable tax rate is 40%.There are no other temporary or permanent differences.

The applicable tax rate is 40%.There are no other temporary or permanent differences.

-Franklin's balance sheet at the end of its first year would report:

A) A deferred tax liability of $16 among noncurrent liabilities.

B) A deferred tax liability of $16 among current liabilities.

C) A deferred tax asset of $16 among noncurrent assets.

D) A deferred tax asset of $16 among current assets.

Correct Answer:

Verified

Q23: Which of the following statements is true

Q27: Which of the following creates a deferred

Q34: Use the following to answer questions

For

Q37: Use the following to answer questions

The

Q38: Use the following to answer questions

The

Q40: Suppose that,in 2017,legislation revised the income tax

Q43: A deferred tax asset represents a:

A) Future

Q43: What would Kent's income tax expense be

Q47: Of the following temporary differences, which one

Q59: Of the following temporary differences, which one

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents