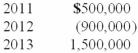

Theodore Enterprises had the following pretax income (loss) over its first three years of operations:  For each year there were no deferred income taxes and the tax rate was 30%. In its 2012 tax return, Theodore elected a loss carryback. No valuation account was deemed necessary for the deferred tax asset as of December 31, 2012. What was Theodore's income tax expense for 2013?

For each year there were no deferred income taxes and the tax rate was 30%. In its 2012 tax return, Theodore elected a loss carryback. No valuation account was deemed necessary for the deferred tax asset as of December 31, 2012. What was Theodore's income tax expense for 2013?

A) $450,000.

B) $330,000.

C) $270,000.

D) $180,000.

Correct Answer:

Verified

Q90: Puritan Corp. reported the following pretax accounting

Q91: A reconciliation of pretax financial statement income

Q94: How should Hobson report tax on the

Q96: The Bell Company had the following operating

Q97: Clinton Corp. had the following pretax income

Q109: What should Hobson report as net income?

A)$70

Q111: How much tax expense on income from

Q112: On its tax return at the end

Q119: Due to differences between depreciation reported in

Q127: Roberts Corp. reports pretax accounting income of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents