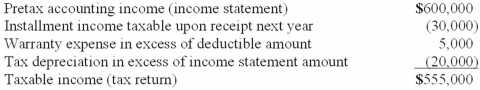

A reconciliation of pretax financial statement income to taxable income is shown below for See Shipping for the year ended December 31, 2013, its first year of operations. The income tax rate is 40%.  What amount should See report as a current item related to deferred income taxes in its 2013 balance sheet?

What amount should See report as a current item related to deferred income taxes in its 2013 balance sheet?

A) Deferred income tax asset of $12,000.

B) Deferred income tax asset of $2,000.

C) Deferred income tax liability of $12,000.

D) Deferred income tax liability of $10,000.

Correct Answer:

Verified

Q80: In 2013, Bodily Corporation reported $300,000 pretax

Q82: Reliable Corp. had a pretax accounting income

Q83: At December 31, 2013, Moonlight Bay Resorts

Q90: Puritan Corp. reported the following pretax accounting

Q99: Financial statement disclosure of the components of

Q105: Madison Company has taken a position in

Q111: How much tax expense on income from

Q114: What should Hobson report as income from

Q119: Due to differences between depreciation reported in

Q127: Roberts Corp. reports pretax accounting income of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents