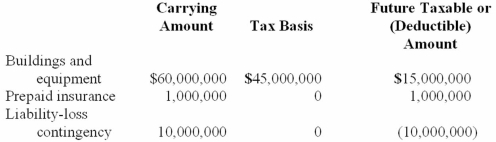

The information below pertains to Mondavi Corporation:

(a.) For the current year temporary differences existed between the financial statement carrying amounts and the tax basis of the following:  (b.) No temporary differences existed at the beginning of the year.

(b.) No temporary differences existed at the beginning of the year.

(c.) Pretax accounting income was $300,000,000 and taxable income was $120,000,000 for the year and the tax rate is 40%.

Required:

Prepare one journal entry to record the tax provision for the current year. Provide supporting computations.

Correct Answer:

Verified

Q124: The information that follows pertains to Julia

Q126: Four independent situations are described below. Each

Q130: Brook Company has taken a position on

Q131: Four independent situations are described below. Each

Q161: Some accountants believe that deferred taxes should

Q163: Identify three examples of permanent differences between

Q164: What argument serves as the basis for

Q165: What is the justification for a corporation

Q167: Sometimes a temporary difference will produce future

Q171: How are deferred tax assets arising from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents