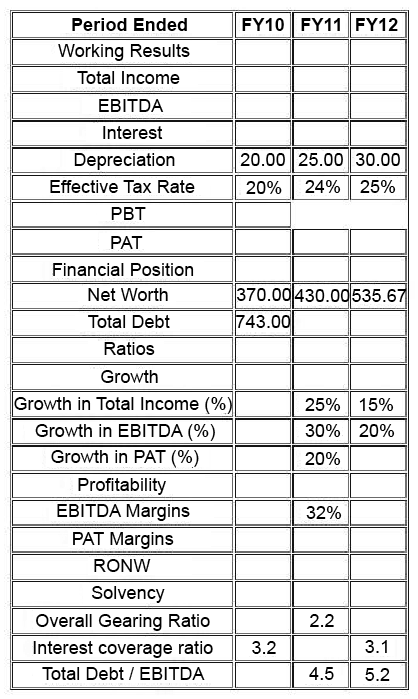

Ms. Mary Brown is a credit rating analyst. She had prepared a detailed report on one of her client, FlyHigh Airlines Ltd, a company operating chartered aircrafts in India. As she was heading for a meeting with her superior on the matter, coffee spilled over her set of prepared paper(s) . As she was getting late for meeting, instead of preparing entire set she could recollect few numbers from her memory and reconstructed following partial financial table:  An analyst comparing two competitors Comp Systems and Big Tables gathers the data below: Cash Conversions Cycle: Comp Systems: 18 days and Big Tables 32 days Defense Interval Ratio: Comp Systems: 50 and Big Tables: 20 What can the analyst conclude regarding the liquidity of these companies?

An analyst comparing two competitors Comp Systems and Big Tables gathers the data below: Cash Conversions Cycle: Comp Systems: 18 days and Big Tables 32 days Defense Interval Ratio: Comp Systems: 50 and Big Tables: 20 What can the analyst conclude regarding the liquidity of these companies?

A) Both indicators suggest that Comp Systems is more liquid than Big Tables

B) Both indicators suggest that Big Tables manages it/s cash better than Comp Systems

C) Both indicators give contradictory results

D) While Comp Systems is more liquid as per the Cash conversion cycle, Big Tables manages its cash better as indicated by a lower, hence better Defense Ratio

Correct Answer:

Verified

Q13: If XYZ Ltd. incurs (with purchase and

Q14: Loss assets should be written off. If

Q15: Two economies HardLand and SincereLand have provided

Q16: Ms. Mary Brown is a credit rating

Q17: Scott is a credit analyst with one

Q19: Case Facts as on March 31, 2012

Q20: Following is information related banks: Auckland Ltd

Q21: Basket Default swaps could be

A) reference sectors

Q22: Which of the following shall not be

Q23: Z spreads in Callable bonds include:

A) Does

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents