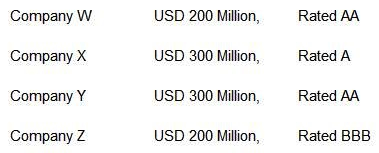

Bank A has an imaginary portfolio of USD 1000 Million distributed towards following four entities:  Bank A is stipulated to maintain a capital adequacy ratio of 11% on its risk weighted assets. It is being stipulated that the ratings for all the four entities is expected to be downgraded by 1 notch each. Estimate the amount of new capital required for Bank A?

Bank A is stipulated to maintain a capital adequacy ratio of 11% on its risk weighted assets. It is being stipulated that the ratings for all the four entities is expected to be downgraded by 1 notch each. Estimate the amount of new capital required for Bank A?

A) USD 93.5 Million

B) USD 38.5 Million

C) USD 55 Million

D) USD 850 Million

Correct Answer:

Verified

Q44: Which of the following factor is considered

Q45: During FY13, Small Bazar, a leading retail

Q46: The _ cycle is the length of

Q47: Which of the following is false in

Q48: Based on the Moody's KMV model which

Q50: Project 1: Company X has a sugar

Q51: Which of the following may lead to

Q52: Short term rates are determined by_

A) All

Q53: Stand by letter of credits are typically

Q54: Step up upon feature will lead to

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents