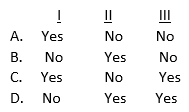

The financial statements of KCP America, a U.S. entity, are prepared for inclusion in the consolidated financial statements of its non-U.S. parent. These financial statements are prepared in conformity with the accounting principles generally accepted in the parent's country and are for use only in that country. How may KCP America's auditor report on these financial statements?

A) A U.S.-style report (unmodified) . II. A U.S.-style report modified to report on the accounting principles of the parent's country. III. The report form of the parent's country.

B) Option A

C) Option B

D) Option C

E) Option D

Correct Answer:

Verified

Q17: Which of the following procedures most likely

Q636: Green, CPA, was engaged to audit the

Q637: Which of the following is true regarding

Q638: Green, CPA, concludes that there is substantial

Q640: How does an auditor make the following

Q642: An auditor concludes that a substantive auditing

Q643: In connection with a proposal to obtain

Q644: Subsequent to the issuance of an auditor's

Q645: Which of the following is true regarding

Q646: An auditor reads the letter of transmittal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents