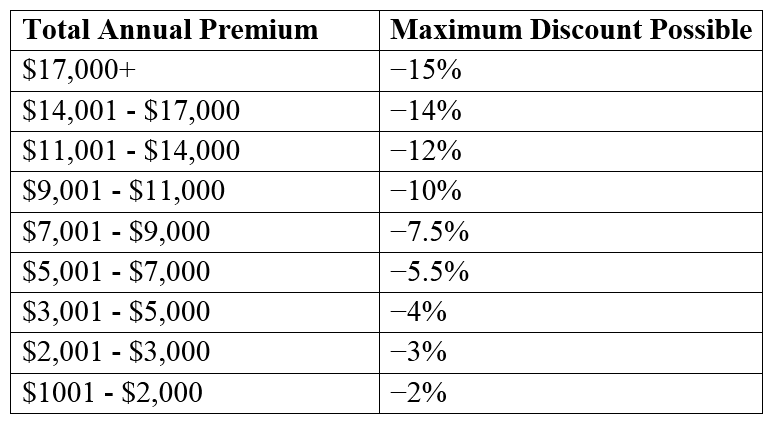

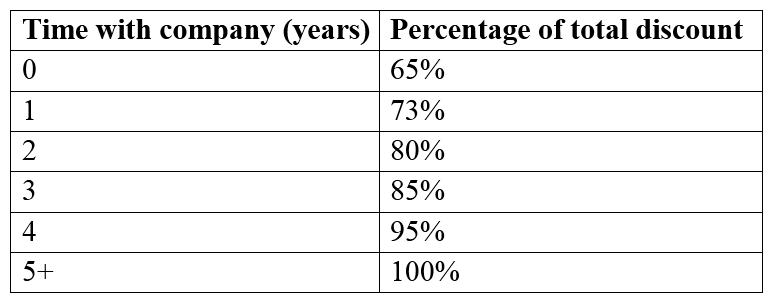

An insurance company wants to increase sales by 15% and customer retention by 10% within 1 calendar year. Various strategies to achieve this were considered and a restructure to the existing pricing model is selected to help achieve these goals. A business analyst (BA) works with stakeholders such as actuaries, product specialists, sales staff, risk managers, and underwriters who agree to applying varying levels of discounts to customers based on: • Total annual premium the customer has with the company (Financial worth) • Time with the insurance company (Loyalty) Various financial models are considered but the stakeholders agree that an initial applicable discount is determined based on the customer's overall premium:  The percentage of the maximum possible discount available to the customer is adjusted based on time with the company:

The percentage of the maximum possible discount available to the customer is adjusted based on time with the company:  What did the BA create to ensure that everyone who needed to be included had been?

What did the BA create to ensure that everyone who needed to be included had been?

A) Onion diagram

B) Concept model

C) Capability diagram

D) Context model

Correct Answer:

Verified

Q427: A company that specialized in manufacturing vending

Q428: A national branch of a global company

Q429: A solution implemented three months ago has

Q430: After releasing its beta version of a

Q431: A popular department store chain wants to

Q433: A martial arts organization has been expanding

Q434: The business analyst (BA) has been tasked

Q435: A very large insurer of General Liability

Q436: Most users of a pilot application have

Q437: A business analyst (BA) elicits requirements for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents