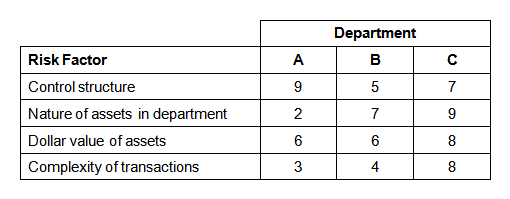

A bank uses a risk analysis matrix to quantify the relative risk of auditable entities. The analysis involves rating auditable entities on risk factors using a scale of 1 to 10, with 10 representing the greatest risk. A partial list of risk factors and the ratings given to three of the bank's departments is provided below:  Which of the following statements regarding risk in the department is true?

Which of the following statements regarding risk in the department is true?

A) As compared to departments A and C, department B has a stronger control system to compensate for the greater complexity of the department's transactions and dollar value of its assets.

B) The internal audit activity should schedule audits of department B more often than audits of department C because of the relative control strength of department C as compared to department B.

C) The nature of department A's control structure may be justified by the nature of the department's assets and the complexity of its transactions.

D) The relative ranking of the departments in order of their risk, from greatest to least risk, is: A; C; B.

Correct Answer:

Verified

Q176: Which of the following is typically not

Q177: A chief audit executive agrees to conduct

Q178: If participants in a control self-assessment workshop

Q179: Which of the following best defines an

Q180: An internal auditor has completed an audit

Q182: Risk assessments can vary in format, but

Q183: Which of the following is least likely

Q184: Which of the following factors would not

Q185: An organization has developed a large database

Q186: Confirmation would be most effective in addressing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents