On June 1, Jenni invested $4,000 into a mutual fund. By December 31, the value of the mutual fund had increased to $5,200. Jenni did not sell any portion of the mutual fund during the year. Assuming Jenni's income tax rate on this investment will be 25%, the journal entry to record the income tax expense is

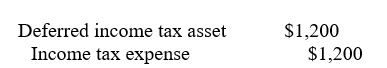

A)

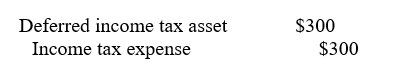

B)

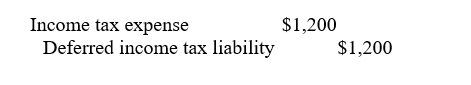

C)

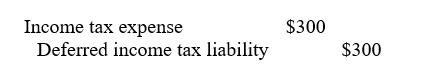

D)

Correct Answer:

Verified

Q36: Which type of pension plan promises employees

Q37: Sales Taxes Payable is normally classified as

Q38: A cash compensation received by an employee

Q39: Income taxes shown on the income statement

Q40: The yearly increase in the pension obligation

Q42: Which of the following types of contingencies

Q43: The accounting term for an uncertain circumstance

Q44: The required recording of research and development

Q45: Which of the following is the required

Q46: Which of the following types of advertising

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents