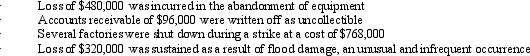

Dike Corporation incurred the following losses during 2012:  Ignoring income taxes, what amount of loss should Dike report as extraordinary on its annual income statement?

Ignoring income taxes, what amount of loss should Dike report as extraordinary on its annual income statement?

A) $320,000

B) $480,000

C) $864,000

D) $1,664,000

Correct Answer:

Verified

Q73: On December 31, 2012, Johnson Corporation reported

Q74: Which of the following items would NOT

Q75: Which of the following items would be

Q76: What effect does an extraordinary item have

Q77: Which type of income shows how much

Q79: Which of the following is NOT a

Q80: Which of the following items should be

Q81: Fonda Company's fiscal year is the calendar

Q82: Indicate the appropriate accounting treatment for each

Q83: Gowrie, Inc. began operations on January 1,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents