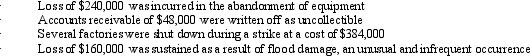

Romulus Corporation incurred the following losses during 2012:  Assuming that Romulus has a 40% income tax rate, what amount of net loss should Romulus report as extraordinary on its annual income statement?

Assuming that Romulus has a 40% income tax rate, what amount of net loss should Romulus report as extraordinary on its annual income statement?

A) $96,000

B) $144,000

C) $259,200

D) $499,200

Correct Answer:

Verified

Q63: Assante Corporation reported the following data for

Q64: The following information was taken from the

Q65: Items incurred or earned from activities peripheral

Q66: Which of the following are reported on

Q67: Earnings per share is NOT calculated on

Q69: The following information is from Everly Corp.'s

Q70: Diluted earnings per share includes stock transactions

Q71: Earnings per share is equal to

A) Total

Q72: Which of the following events would be

Q73: On December 31, 2012, Johnson Corporation reported

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents