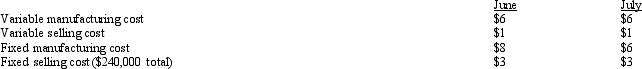

Exhibit 20-6 Vilas Company manufactured 80,000 units during July but only sold 65,000 of these units at a price of $20 each. At the beginning of the month, Vilas had 5,000 units in finished goods inventory. The following unit costs are known for June and July: Vilas Company uses the first-in first-out (FIFO) method.

Vilas Company uses the first-in first-out (FIFO) method.

Refer to Exhibit 20-6. What is net income for July using the variable costing method?

A) $205,000

B) $85,000

C) $215,000

D) $125,000

Correct Answer:

Verified

Q68: Which of the following is true regarding

Q69: Which inventory costing method allows net income

Q70: Which of the following is the income

Q71: Exhibit 20-5 Barron Company manufactured 150,000 units

Q72: What is the main difference between an

Q74: Last year, Racine Company's income under absorption

Q75: Which inventory costing method is required by

Q76: Exhibit 20-5 Barron Company manufactured 150,000 units

Q77: Exhibit 20-5 Barron Company manufactured 150,000 units

Q78: Which inventory costing method assigns fixed production

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents