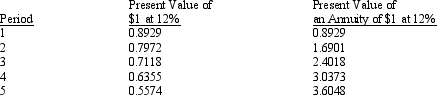

Clarke Company purchased equipment for $100,000 that is expected to generate cash inflows from operations of $30,000 in each of the next 5 years. The machine will be depreciated on a straight-line basis with no salvage value. Assume the following present value factors:  What would be the net present value of the investment by Clarke Company?

What would be the net present value of the investment by Clarke Company?

A) $8,144

B) $8,881

C) $12,100

D) $16,288

Correct Answer:

Verified

Q37: Which of the following is true?

A) Present

Q38: The "true" discount rate of a capital

Q39: A $240,000 asset that is being depreciated

Q40: Which of the following is a characteristic

Q41: Gallatin Co. is considering the purchase of

Q43: The internal rate of return method provides

Q44: When using the internal rate of return

Q45: The net present value of a proposed

Q46: If the net present value of an

Q47: Crawford Company expects to invest $144,000 in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents