A comparison of the balance in Cottonwood Company's cash account (per its books)as of April 30,2009,and the bank statement dated April 30,2009,revealed the following information:

Required:

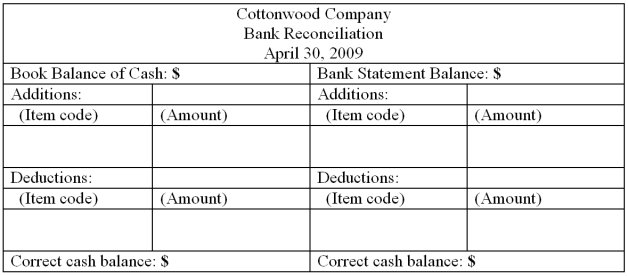

Prepare a bank reconciliation using the format below.Indicate the proper handling of each of the items given above by listing the appropriate item code (letter)and amount under each section of the reconciliation statement form below.Then determine the correct cash balance.

Note:

If one or more of the items given above should not appear on the reconciliation statement,do not include the item(s).

Correct Answer:

Verified

Q100: The Rye Corporation has provided the following

Q101: On January 1,American Company's allowance for doubtful

Q102: Hill Company has reported the following

Q103: Cyclone Inc.reported the following figures from

Q104: Burke Company has just received its

Q106: Illinois Company prepared the following bank

Q107: Cyclone Inc.reported the following figures from

Q108: Prior to the year-end adjustment to

Q109: Chicago Company has hired you to

Q110: Asia Company sold $10,000 of goods to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents