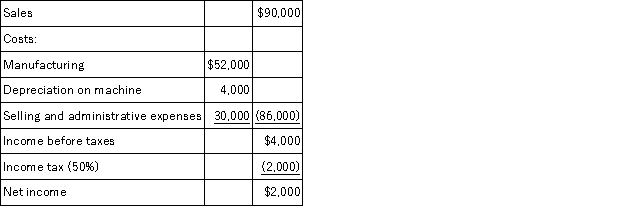

A company is planning to purchase a machine that will cost $24,000,have a six-year life,and be depreciated over a three-year period with no salvage value.The company expects to sell the machine's output of 3,000 units evenly throughout each year.A projected income statement for each year of the asset's life appears below.What is the payback period for this machine?

A) 24 years.

B) 12 years.

C) 6 years.

D) 4 years.

E) 1 year.

Correct Answer:

Verified

Q47: A company has the choice of either

Q70: Markson Company had the following results of

Q71: A company has the choice of either

Q72: Frederick Co.is thinking about having one of

Q73: Porter Co.is analyzing two projects for the

Q76: A company is considering the purchase of

Q76: Benjamin Company had the following results of

Q77: A company is considering the purchase of

Q78: Lattimer Company had the following results of

Q79: A disadvantage of using the payback period

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents