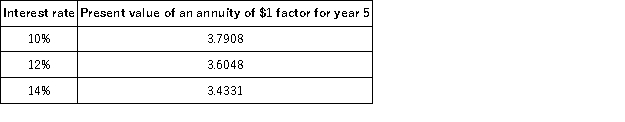

Tressor Company is considering a 5-year project.The company plans to invest $90,000 now and it forecasts cash flows for each year of $27,000.The company requires that investments yield a discount rate of at least 14%.Selected factors for a present value of an annuity of 1 for five years are shown below:  Calculate the internal rate of return to determine whether it should accept this project.

Calculate the internal rate of return to determine whether it should accept this project.

A) The project should be accepted because it will earn more than 14%.

B) The project should be accepted because it will earn more than 10%.

C) The project will earn more than 12% but less than 14%.At a hurdle rate of 14%,the project should be rejected.

D) The project should be rejected because it will earn less than 14%.

E) The project should be rejected because it will not earn exactly 14%.

Correct Answer:

Verified

Q47: A company has the choice of either

Q68: The hurdle rate is often set at:

A)

Q76: Benjamin Company had the following results of

Q77: A company is considering the purchase of

Q78: Lattimer Company had the following results of

Q79: A disadvantage of using the payback period

Q82: Butler Corporation is considering the purchase of

Q84: A company can buy a machine that

Q84: A company is considering the purchase of

Q86: The following data concerns a proposed equipment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents