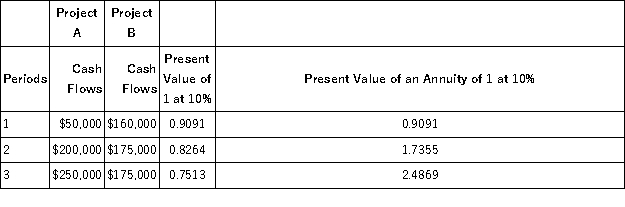

Trevoline Company is deciding between two projects.Each project requires an initial investment of $350,000.The projected net cash flows for the two projects are listed below.The revenue is to be received at the end of each year.Trevoline requires a 10% return on its investments.The present value of an annuity of 1 and present value of an annuity factors for 10% are presented below.Use net present value to determine which project should be pursued and explain why.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q149: A company is trying to decide which

Q155: In this chapter,you examined several short-term managerial

Q156: A capital budgeting method that considers how

Q157: The net present value decision rule requires

Q162: A(n) _ is the potential benefit lost

Q167: A(n) _ requires a future outlay of

Q174: Relevant costs are also known as _.

Q175: Mays Company can sell all of product

Q183: A(n) _ arises from a past decision

Q184: The _ is computed by dividing a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents