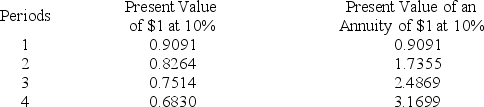

Poe Company is considering the purchase of new equipment costing $80,000.The projected annual cash inflows are $30,200,to be received at the end of each year.The machine has a useful life of 4 years and no salvage value.Poe requires a 10% return on its investments.The present value of $1 and present value of an annuity of $1 for different periods is presented below.

-Compute the net present value of the machine.

A) $(15,731) .

B) $(4,896) .

C) $15,731.

D) $4,896.

E) $32,334.

Correct Answer:

Verified

Q104: Butler Corporation is considering the purchase of

Q104: A new manufacturing machine is expected to

Q106: A company is considering a 5-year project.The

Q107: Alfarsi Industries uses the net present value

Q107: A machine costs $180,000 and will have

Q108: Tressor Company is considering a 5-year project.The

Q110: Alfarsi Industries uses the net present value

Q112: The following present value factors are provided

Q113: A company is considering the purchase of

Q114: Turk Manufacturing is considering purchasing two machines.Each

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents