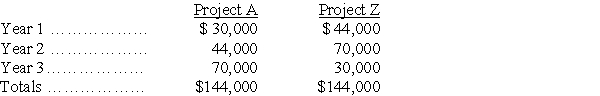

A company is considering two alternative investment opportunities,each of which requires an initial cash outlay of $110,000.The expected net cash flows from the two projects follow:

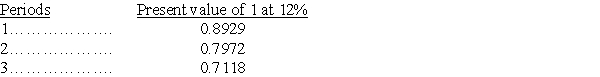

Based on a comparison of their net present values,and assuming the same discount rate of 12% is required for both projects,which project is the better investment? Use the table values below to compute the net present value of each project's cash flows.

Based on a comparison of their net present values,and assuming the same discount rate of 12% is required for both projects,which project is the better investment? Use the table values below to compute the net present value of each project's cash flows.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q142: A company is trying to decide which

Q145: A company is considering two projects,Project A

Q146: A company produces two boat models,Flyer and

Q148: A company is considering the purchase of

Q150: A company is considering a proposal to

Q152: Dracor Company is considering the purchase of

Q169: A company is evaluating the purchase of

Q184: The _ is computed by dividing a

Q185: A capital budgeting method that considers how

Q188: The _ is computed by discounting the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents