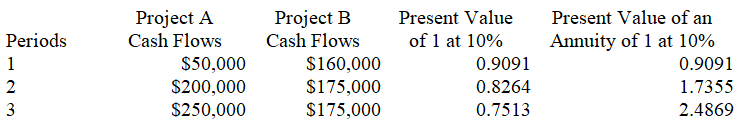

Trevoline Company is deciding between two projects.Each project requires an initial investment of $350,000.The projected net cash flows for the two projects are listed below.The revenue is to be received at the end of each year.Trevoline requires a 10% return on its investments.The present value of an annuity of 1 and present value of an annuity factors for 10% are presented below.Use net present value to determine which project should be pursued and explain why.

Correct Answer:

Verified

Both projects have a positive net prese...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q152: Dracor Company is considering the purchase of

Q154: A company is considering a 5-year project.It

Q155: A company has a decision to make

Q160: Presented below are terms preceded by letters

Q161: The minimum acceptable rate of return on

Q161: Match the letter of the term with

Q168: A company purchases a machine for $800,000.

Q169: A company is evaluating the purchase of

Q182: In evaluating capital budgeting alternatives, there are

Q186: The _ is the rate that yields

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents